How to Trade the GBP/USD Currency Pair?

GBP/USD (Great Britain pound vs US dollar) is a major currency pair, which means it is one of the main and liquid Forex assets alongside EUR/USD, USD/CHF, AUD/USD, USD/JPY, and others. There is evidence that it takes from 12% to 17% of the total market trade turnover.

The base currency is the British pound and the quote one – the US dollar. This means that when the pair is growing, the pound is getting stronger while the USD is weakening.

Many call the British pound one of the most aggressive currencies in the financial market, and this is what creates high volatility in the pair. The behavior of these quotations is often unpredictable; they create a lot of false breakaways of support/resistance levels on the chart.

In this article, we will speak in more detail about the history of the pair, describe the factors that influence its behavior, and suggest a simple trading strategy.

1,000,000 USD RoboForex partner promotion!

Learn more about the participation conditions and join the cash prize draws

Join and Win

Short history of GBP/USD

The full name of the British national currency is the sterling pound. The history of the currency dates back to the year 775. As long as the relationship between Britain and its colonies was developing, the necessity to pay for goods and overseas transportation emerged.

One version of where the name “sterling pound” comes from the method of coinage at those times. They used silver, and 1 pound of silver produced 240 coins. They started being called “sterling”, and this term was officially accepted for the currency in 1694.

As for the GBP/USD pair, its second non-official name – Cable – is derived from a real cable stretched along the bottom of the Atlantic Ocean for uninterrupted exchange of the pair’s quotations.

Now let us switch from history to the meat.

What does influence the GBP/USD quotations?

The main driver of GBP/USD behavior is macroeconomic data and indices from Great Britain. However, there are two more factors:

- The general situation in the currency market

- The difference between interest rates in Great Britain and the USA.

The credit and monetary policy of the Central bank of England is the key element that forms the pound quotations in the world currency market. After Brexit, the CB took some measures for the stabilization and restoration of the GBP rate in the global market, which are still active.

The main “leverage” of the BoE for controlling the GBP rate is the interest rate decisions. When the rate increases, the pound gets stronger. When the rate declines, the British currency weakens.

Other economic events from the Foggy Albion influence the GBP/USD rate as well. Among them such things as:

- GDP information, published once in 3 months;

- The Consumer Price Index. It demonstrates the inflation rate that directly influences the decision on the key interest rate;

- The number of unemployment claims;

- The PMI.

The last two indices give an idea of the economic situation in Great Britain.

With all the news from the British Isles we should not forget about the USA. They also influence the quotations. Among them there are the same reports: the GDP, interest rates, employment and unemployment information. You can check these events on the economic calendar, for example, on the westernfx website.

Discover a new level of trading with R MobileTrader app

One app to trade them all: Stocks, Indices, Metals, Oil, Currencies

How to trade GBP/USD?

To work successfully with the pair, you need to figure out and understand its peculiarities, including the period of its peak activity. The average daily volatility level is 100-140 points. Trade is most active during the American and European trading sessions.

To trade GBP/USD, you can choose any type of analysis and signals – from simple fundamental analysis to technical indicators.

The most passive period for the pair is the Asian session (because in Europe, it is night) – at that time, volatility remains within 30 points. Most often, the British pound behaves unpredictably and/or ambiguously: it might drop when everyone expects growth, and vice versa. The price might react to some news immediately but also might lag and do it gradually.

Let us discuss several ways of trading GBP/USD by different types of analysis.

Trading GBP/USD by fundamental analysis

We have already discussed the main economic events that influence the currency pair. The trader only needs to check the economic calendar accurately and remain in course of the main economic events from Great Britain and the USA.

The high volatility of the pair might further increase when certain economic news is published; at such times, be extra attentive and do not dismiss the idea of using Stop Losses. To trade GBP/USD by fundamental analysis you can use both short-term (intraday) and medium-term strategies.

Example

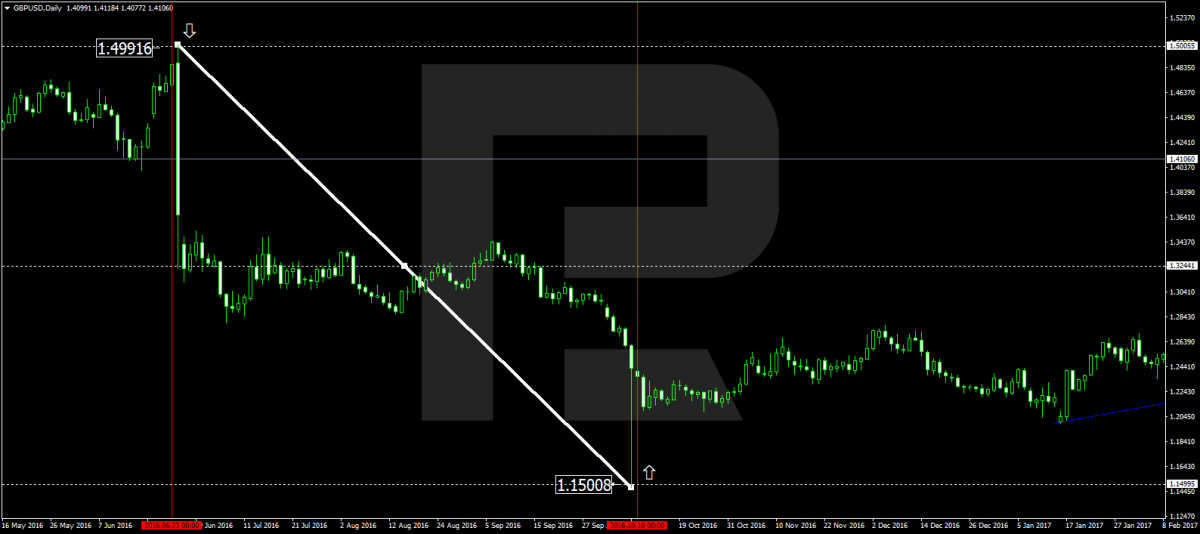

Check the chart of the pair at the moment when Brexit was announced on June 23rd 2016.

The falling started right after the referendum and lasted for 3 months. The market slumped by over 4,000 points.

Trading GBP/USD by tech analysis

For such trading, any methods of tech analysis will do. You can use original methods (by Elliott, Williams, Raschke) or tech analysis patterns. The principles of their use do not differ from those for other currency pairs.

Example

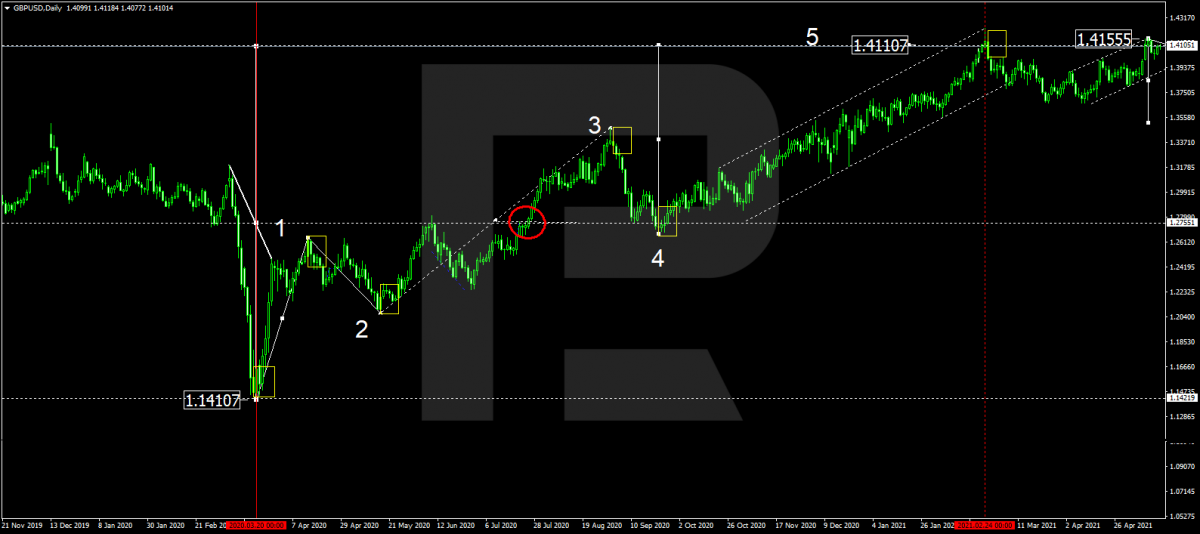

Check the chart of the pair from March 20th, 2020. A Head and Shoulders pattern formed there.

The structure took some 11 months to form. The market grew by almost 2,700 base points.

Trading GBP/USD by indicators

You can get signals for GBP/USD from both trend indicators and oscillators. A standard set of indicators on the MetaTrader 4 platform will be quite enough.

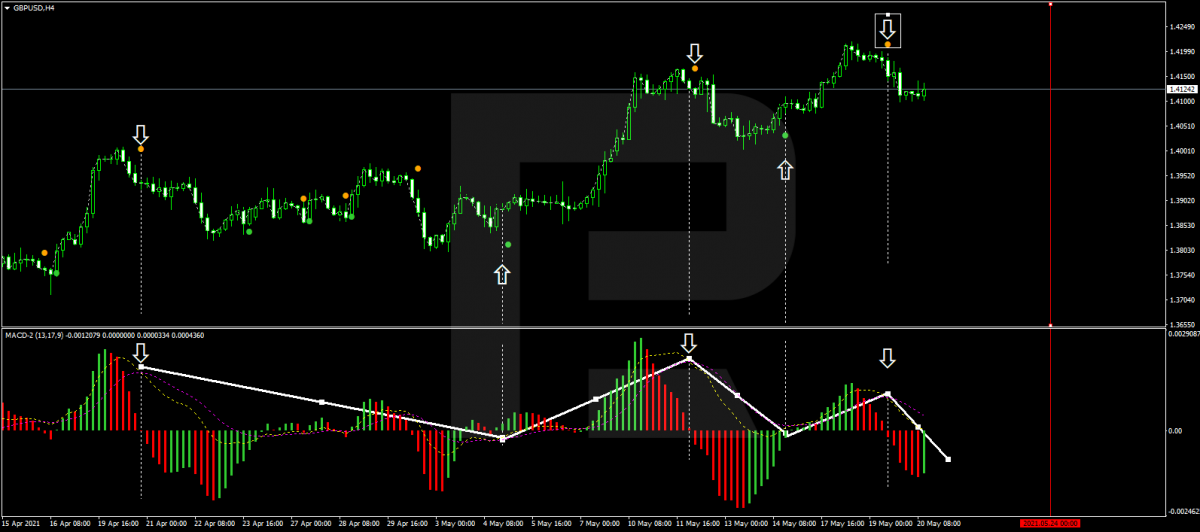

As an example, take a look at using the MACD for getting signals.

The following strategies suit this pair perfectly:

- The Moving Average strategy

- The SMA Tunnel strategy

- The Magic Grid strategy

- Fibonacci levels.

Short on time for full-fledged trading?

Register in the CopyFX copy trading system and start copying the trading strategies of top-ranking traders right now!

Start Investing

A strategy of trading GBP/USD during the European session

The European trading session starts in Frankfurt at 07:00 (GMT). The trader needs to keep an eye on the quotation at both sides from the opening price.

The algorithm is as follows:

- Wait for a movement 30-40 points above/below the opening price.

- This movement creates a certain trading range. Enter the market when either border of the channel is breached. The better option is for the price to go to the low, then to the high, and then break through the low. A vice versa pattern is also good: the price rises to the high, then falls to the low, then breaks through the high.

- The primary Stop Loss is placed 40 points away from the entry point.

- Take the profit sized half of the position volume when those 40 points are reached. For the remaining position, place a Trailing Stop sized 20 points.

Avoid situations when the initial movement in any direction is larger than 40 points. Such high-volatility movements create vast ranges for potential tracking and opening positions; it poorly suits comfortable trading.

As long as we wait for 30 points at both sides of the opening price, you sometimes need to wait for an hour or more for a trading signal to appear. Avoid entering the market when a breakaway has not happened yet.

Closing thoughts

The British economy is considered to be the 5th in the world, and the pound (GBP) is one of the most popular Forex currencies. Many Forex traders choose the pound as their favorite currency or the only one they trade.

GBP/USD can be traded by various instruments; they will help you if you master them. Of course, you need to remember about the rules of risk and money management and accurately follow them. Studying trader’s psychology will not be a bad idea either. All these measures together will help you understand the market better.

Keep in mind that the volatility of GBP/USD is increased, so start on a demo account and switch to a real one after a deal of practice.

We wish you good luck and good trends!